Starting from June of this year, the credit sector in the UAE shows various dynamics. During this time, the financing rates for electricity, water, and gas decreased from 53.2 billion dirhams to approximately 51.5 billion dirhams, which constitutes a reduction of 1.7 billion dirhams. At the same time, personal consumption credits grew from 460.4 billion dirhams in June to 484.8 billion dirhams by the end of September.

The Central Bank reported that financing provided by banks in the country for various economic activities, including government activities, amounted to 43.4 billion dirhams over three months. This represents an increase from 1.8164 trillion dirhams at the end of June this year to 1.8598 trillion dirhams by the end of September 2024, which reflects the strength of the economy and the growth of commercial and investment activities in the country.

According to the latest statistical data from the Central Bank on financing of economic activities, presented on a quarterly basis, financing provided by banks for various economic activities includes 12 main sectors.

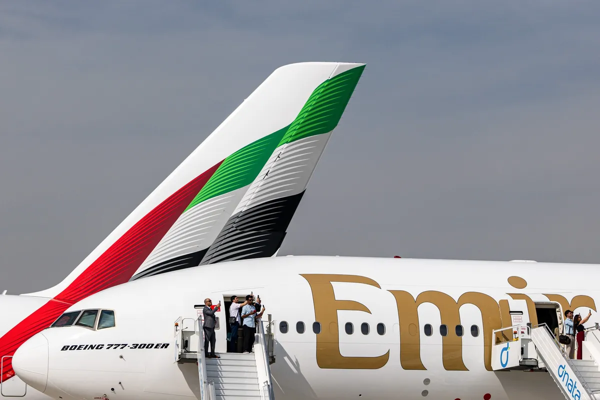

Financing in the transport and communications sector increased from 93.7 billion dirhams to 102.2 billion dirhams. Credits for trade in general, including wholesale and retail trade, increased from 168.1 billion dirhams at the end of June to 169.2 billion dirhams by the end of September.

Bank financing for government activities grew from 185.7 billion dirhams to 188.4 billion dirhams. Consumer credit in the active sectors grew from 460.4 billion dirhams to 484.8 billion dirhams.

Regarding the industrial sector, financing increased from 93.9 billion dirhams to 94.8 billion dirhams. Lending in the construction and real estate sector also increased from 268.7 billion dirhams to 269.2 billion dirhams.

At that same time, financing for extraction of useful minerals and quarries increased from 17.4 billion dirhams to 19.2 billion dirhams, while credit for agriculture fell from 2.5 billion dirhams to 1.8 billion dirhams.